CanLaw

CanLaw

Credit Problems? How to legally reduce or eliminate all your debts.

Current as of

PAY DAY LOANS ARE AS DANGEROUS AS CRACK

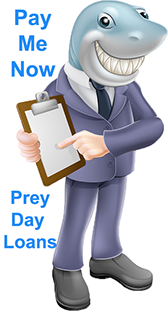

BEWARE: PAY DAY LOAN SHARKS AND CHEQUE CASHING SCAMS WILL ROB YOU BLIND

Don't be a sucker and a victim.

Avoid these loan sharks at all costs.

Prey Day loan sharks are for losers

Payday loans are a dangerous trap.

Your first loan must be paid in full in 2 weeks. You need all of your pay cheque to live on. so you need a new loan to pay the original loan and on and on.

You will need to take a second loan to pay the first and a third to pay the second and on and on. Huge admin fees and 500% interest have you in a cycle of debt.

It may seem like you have no other choice but pay day loans in an emergency, Taking out a payday loan lowers your credit score, will eat up any savings you could have had.

THEY DEFINITELY WILL SUE YOU

IF YOU DO NOT PAY.

WARNING Avoid All Pay Day Loan Sharks or Cheque Cashing Outfits.

BEWARE: DO NOT DEAL WITH LOAN SHARKS

USING DESCRIPTIONS LIKE THESE

Payday Loans, Quick Cash Loans, Cash Advance Loans, Deferred Deposit Loans, Check Advance Loans, Post Dated Cheque Loans, Cheques Cashed. No Credit Check,Fast or Quick Cash, Get Money Now, Bad Credit OK

BEWARE OF PREY DAY LOAN RIP OFFS

AND

CHEQUE CASHING SERVICES.

The Federal Government has introduced legislation lowering the maximum interest rate specifically in order to curb these bandits. Both charge outrageous, probably illegal fees.

Pay-day loan sharks are charging annual rates of interest as high as 360% for advance loans, which is why several class-action lawsuits are now swirling.

Some credit card issuers face lawsuits over gouging rates on cash advances.

Both rip off the poor and leave them in worse shape than before. If you need to use a pay day loan service, you are already in deep financial trouble and need to get help... fast.

CREDIT CARD CASH ADVANCES?

Your credit card company considers taking cash advances a possible sign of credit problems and will monitor your account very closely. They also charge higher interest rates for cash advances over regular credit card purchases.

Credit problems warning signs

Before you can determine the best course of action to achieve financial stability, you need to take a look at where you are right now.

Pay day loans are like crack. Once they get you hooked on easy credit, you are trapped for years paying huge interest rates

Prey day loans charge

over 500% interest

You can get a better deal

from the Mafia

The maximum cost of borrowing applies

until the date your loan is due.

Pay Day Loans Are As Addictive As Crack

Pay Day Loans Are Easy Credit Ripoffs

HERE IS HOW THEY GET YOU HOOKED

If you borrow against your next pay cheque, you will probably be short after the next pay cheque so you borrow again. And you are trapped.

Some of the many ways payday loan companies charge illegal interest disguised as fees

Some of the many ways payday loan companies charge illegal interest disguised as fees

Even though the Criminal Code of Canada considers fees and service charges to be interest, which are all charged on a payday loan nothing seems to be done to stop these crooks.

When a new regulation is made law, the pay day loan sharks change the names of their illegal charges to something else.

Each of the following is actually considered under the law to be interest. Added together they usually far exceed the legal amount of interest that can be charged for a loan

- Setup fees

- Account fees

- Administration fees

- Processing fees

- Convenience charges

- Verification fees

- Brokers’ fees

- Collection fees

- Loan repayment fees

- Renewal fees

There are many more terms for the hidden illegal interest charges these crooks use to cheat you.